At XpertSource.com, our mission is to make your real estate journey easier, whether you're buying, selling or refinancing your mortgage. We’re here to guide you every step of the way.

Property valuation is also a key aspect when starting any real estate project. That’s why we’ve created this practical guide, providing you with all the essential information to help you understand this complex process.

What is property valuation? When should you have your property evaluated? Which professional should you hire to assess your property? What valuation methods are used in the field? What factors influence your property’s value?

Our practical guide on property valuation answers all these questions.

What is property valuation?

In simple terms, property valuation is the process of determining the market value of a property.

Before we dive deeper, it’s important to distinguish between municipal valuation and property valuation. These terms are often used interchangeably, but they refer to two different processes with distinct objectives. Understanding the difference is crucial!

What’s the difference between municipal assessment and market value?

A municipal assessment is conducted by local municipalities to determine the amount of property taxed owners must pay each year. In this process, municipalities typically hire certified appraisers to conduct a broad evaluation of many properties at once, providing a general estimate of property values.

It’s important to understand that a municipal assessment does not reflect the current real estate market. As a seller, you should not use the municipal value to set your property’s sale price, as it is often lower than the actual market value.

In contrast, market valuation is a much more precise process. It determines the actual market value of your property; the most probable price you could sell it for under current market conditions. Unlike a municipal assessment, market valuation is tailored to your specific property and reflects its true worth.

To determine that market value, the appraiser will consider several factors, including the property’s condition, its location, land size, and even the current state of the real estate market. These factors will be analyzed in more detail in the next section.

When do you need to know the value of your property?

Now that you have a clear understanding of what property valuation is, and the importance distinction between municipal value and market value, let’s look at some common situations where you may need to have your property valued. Here are five key scenarios in which property valuation is essential.

-

Selling a property

One of the most common situations where a property valuation is required is the sale of a property. If you’re putting your home on the market, it’s essential to have it evaluated. The valuations will help you set the right selling price; one that reflects the true market value of your property.

-

Buying a property

Even if you're a buyer, property valuation may be needed. While you aren’t setting the price, your mortgage lender may require a valuation to approve your loan. The valuation helps the lender assess the property’s value and ensure that it aligns with the loan amount you’re requesting.

Additionally, the result of the valuation ca influence how much you’ll need to pay for your down payment. A lower valuation might increase your down payment requirements, and it could also impact the lender’s decision to approve your mortgage.

-

Refinancing a mortgage

Refinancing your mortgage involved taking out a new loan based on the current value of your property. In most cases, you can borrow up to 80% of your property’s market value. When you apply for refinancing, your lender will require an up-to-date property appraisal to determine the current value of your home, which will directly impact the terms of your new loan.

-

Separation or divorce

If you are going through a separation or a divorce and co-own a property with your former partner, things can get complicated. You’ll need to decide if you want to sell the home or if one partner will rather buy the other one’s share. Regardless of the decision, an appraiser’s involvement will be necessary to determine the current market value of the property and help in negotiating a fair buyout or sale price.

-

Settling an estate

When settling an estate, the executor must inventory the deceased’s assets, including any property. If property is involved, it must be appraised to determine its value. Depending on the deceased’s wishes, the property will either be transferred to their partner, divided among heirs, or sold. In all cases, the market value must be established first.

Getting your property evaluated: which professional to choose?

Property valuation is a complex process, and to ensure accurate results that reflect the current real estate market, you can rely on two key professionals: a real estate broker or a certified appraiser.

Let’s take a look at their qualifications in property valuation.

The real estate broker: an ally for your real estate projects

A real estate broker is a skilled professional who can guide and advise you throughout your buying or selling journey. With their extensive knowledge of the real estate market, brokers are also able to perform property valuations.

For sellers, a broker can help you determine the best asking price for your property, and this service is typically offered at no extra charge. Since a broker’s compensation comes from their commission on the sale, there are no additional fees for the valuation.

However, it’s important to remember that a real estate broker is not a certified valuation expert. While they have a solid understanding of market trends and have covered valuation concepts in their training, they do not have specialized education or formal certification in property appraisal.

5 criteria for choosing your real estate broker

- Hold a valid brokerage licence from the OACIQ.

- Have in-depth knowledge of the desired area.

- Be part of a recognized real estate agency.

- Be available for their clients.

- Have substantial experience and a proven track record.

The certified appraiser: the expert in valuation

When it comes to property valuation, the certified appraiser is the true expert. As their title implies, a certified appraiser specializes in determining the value of real estate.

For accurate and reliable results, it’s best to choose a certified appraiser to assess your property. These professionals undergo rigorous training and certification, equipping them with a deep understanding of real estate values and the factors that influence them. While they may not be as well known to some, certified appraisers are skilled in providing impartial, fair valuations based on a thorough analysis of the property and market conditions.

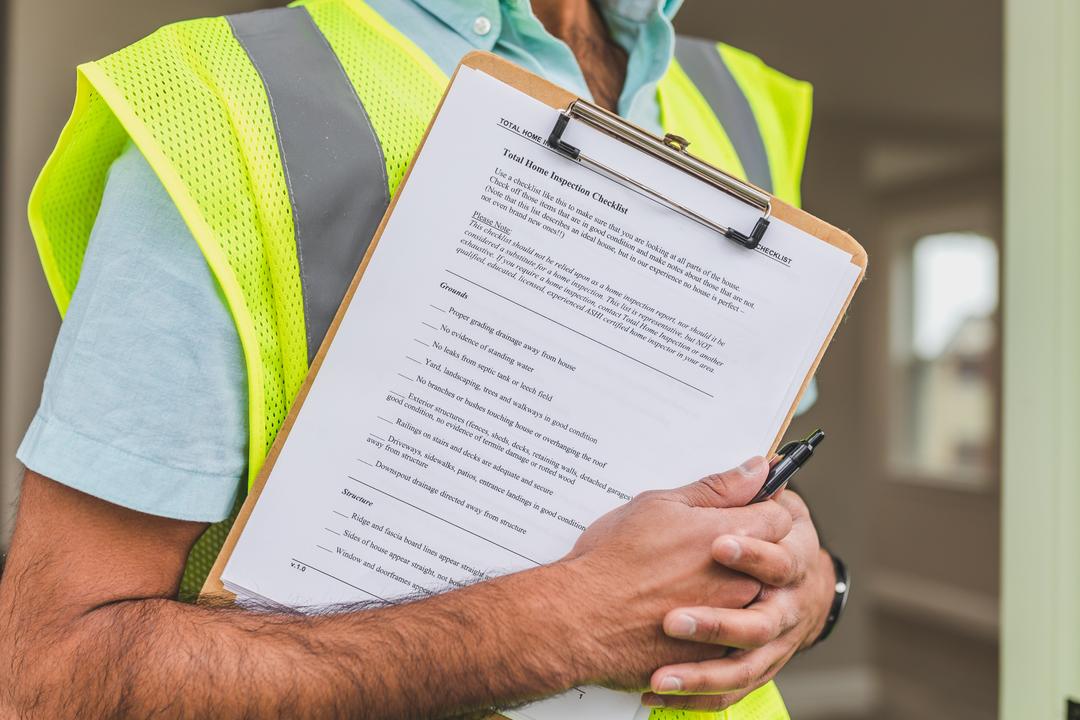

How do they proceed?

The certified appraiser begins by gathering relevant information about your property, its land, and the surrounding neighbourhood to get an overall picture. Then, they visit the property to conduct a thorough visual assessment of its various aspects.

This two-step process enables the appraiser to form an accurate opinion on the market value of your property, which will be presented to you in a detailed written report.

Did you know?

A certified appraiser is not always required to visit the property in person. They can delegate this task to a technician or another employee, who will gather the necessary information. However, the appraisal report must clearly indicate if this delegation took place.

Can you apprise the market value of your property yourself?

If you're selling your home without a real estate agent and want to determine its market value on your own, it is possible but not recommended.

Certified appraisers and real estate agents are professionals with the expertise required to accurately assess the market value of a property. While you can compare your home to similar properties sold through real estate websites, it’s best to leave this task to a professional to ensure a more precise and reliable valuation.

However, if you choose to appraise the market value yourself to set your selling price, here are some important factors to consider:

1. Conduct a thorough market search

Begin by researching the current real estate market. Browse through property sales websites to compare your home with similar properties that are for sale or have recently sold in your area. This will give you a better understanding of the local market and help you gauge a realistic price range for your property.

2. Don’t set your price based on the purchase price

Avoid setting your selling price based on the price you originally paid for the property. Market conditions may have changed since your purchase, and the original price is no longer a reliable reference for the current market value.

3. Keep emotions out of the equation

While you may have an emotional attachment to your home, this should not influence your appraisal. The valuation process should be objective, neutral, and focused solely on the property’s market value, not on personal feelings or memories.

4. Identify your property’s features

Take the time to list all the key features of your property. Each feature, whether it’s the size of the lot, the condition of the kitchen, or unique upgrades, can affect your home’s value. Catalogue these elements carefully, as they can either increase or decrease the market value.

5. Don’t forget about necessary renovations

If there are repairs or renovations that need to be made, like replacing the roof or fixing plumbing issues, factor in the cost of these improvements if you plan to sell before completing them. Failing to account for these necessary updates can lead to an overvaluation of your property.

6. Be fair and realistic

While you want to secure the best price for your home, it’s important to be realistic. Setting an asking price that’s too high can turn potential buyers away. Aim for a price that reflects the current market value and attracts interest from serious buyers.

How to find a certified appraiser to determine the fair market value of a property?

Searching for a certified appraiser can feel overwhelming but knowing where to start can make the process easier. So, how do you find the right professional?

The most important factor in your search is ensuring that the appraiser is a member of the Ordre des évaluateurs agréés du Québec (OEAQ).

This membership is required for certified appraisers to practise legally, meaning they adhere to the ethical standards and regulations of the profession. When you choose an appraiser who is part of this association, you can be confident they are qualified and committed to delivering accurate and unbiased valuations.

Qualities of a good certified appraiser:

- Autonomy

- Analytical mindset

- Integrity

- Objectivity

- Professionalism

- Initiative

If you're unsure where to begin your search, reach out to our team at XpertSource.com. In just a few minutes, our experts can recommend three certified appraisers who meet your needs. You can then contact them directly, compare their quotes, and choose the one that’s right for your project.

How to find a real estate broker to estimate the selling price of a house for free?

A real estate broker is a versatile professional who handles various tasks such as assisting with buying or selling a property, networking, marketing, organizing showings, and more. With so many responsibilities, choosing the right broker for your needs is crucial. So, how do you make an informed decision?

Just as a certified appraiser must be a member of the Ordre des évaluateurs agréés du Québec (OEAQ), a real estate broker must be licensed by the Organisme d’autoréglementation du courtage immobilier du Québec (OACIQ). This ensures they are trained, certified, and have a deep understanding of the real estate market and industry standards.

Qualities of a good real estate broker:

- Good communicator

- Excellent negotiator

- Organized

- Available

- Honest

- Loyal

If you're looking for a real estate broker, our team can assist you in finding the right professional! It only takes a few minutes to connect with experienced brokers in your area.

How much does it cost to have your property appraised?

Unlike appraisals conducted by real estate brokers, the services of a certified appraiser are not free. However, the expertise and accuracy provided by these professionals are generally worth the few hundred dollars you may need to invest. Let’s break down the costs involved.

The cost of a property appraisal can vary depending on several factors, such as:

- The type of building being appraised.

- The location of the property.

- The purpose of the appraisal.

For a more specific estimate, a property appraisal for a typical single-family home generally costs around $650.

Did you know?

The Ordre des évaluateurs agréés du Québec (OEAQ) has not set a standardized fee for appraisers. This means that the price for appraising the same property can vary between professionals. As a result, it’s a good idea to compare rates from multiple appraisers before making a decision.

Property valuation methods

In Quebec, there are 3 recognized property valuation methods: the Comparable method, the Cost method, and the Income method. The appraiser conducting your property valuation will use one or a combination of these methods, depending on the type of property and the purpose of the appraisal.

Want to learn more? Let’s take a closer look at these three valuation methods.

-

The Comparable method

As the name suggests, the Comparable method involves determining the value of your property by comparing it to similar properties. When a certified appraiser uses this method, they select several properties that are similar to yours and use them as benchmarks.

So, how are these properties chosen? Typically, they are recently sold properties within your neighbourhood or municipality that share key characteristics with your property, such as size, age, condition, and style.

Because this method relies on current market data, it is considered highly reliable and is one of the most used approaches. It is frequently used for appraising properties like single-family homes, condominiums, and small multi-unit buildings (5 units or fewer).

-

The Cost method

What if there aren’t enough similar properties recently sold to make a comparison? In that case, the appraiser may use the Cost method. This method considers three key factors:

- The estimated replacement cost of the buildings.

- The value of the land.

- The depreciated components of the property, if applicable.

Though less commonly used, the Cost method is particularly helpful for appraising commercial or industrial buildings, as well as heritage properties or buildings that don’t align with typical market standards.

-

The Income method

The Income method is based on the income and expenses generated by the property. This method is commonly used for appraising income-producing properties, such as rental buildings or commercial real estate. It estimates the property’s market value by evaluating how much income it generates and the associated operating costs.

To get a more accurate market value, the Income method is often used in combination with the Comparable method.

This approach is typically employed for appraising:

- Residential buildings with 6 or more units

- Office buildings

- Commercial rental properties

- Shopping centres

- Industrial rental properties

What factors influence the value of a property?

As mentioned earlier, an appraiser considers several factors when determining the market value of your property. These factors can either increase or decrease the final appraisal result. Let’s explore them in more detail.

-

The location of the property

The location of your property is often the most significant factor influencing its market value. The neighbourhood or area, proximity to essential services, schools, and public transportation, and the overall environment, whether it’s urban or rural, near the water, or with a scenic view, all play a major role in determining value.

-

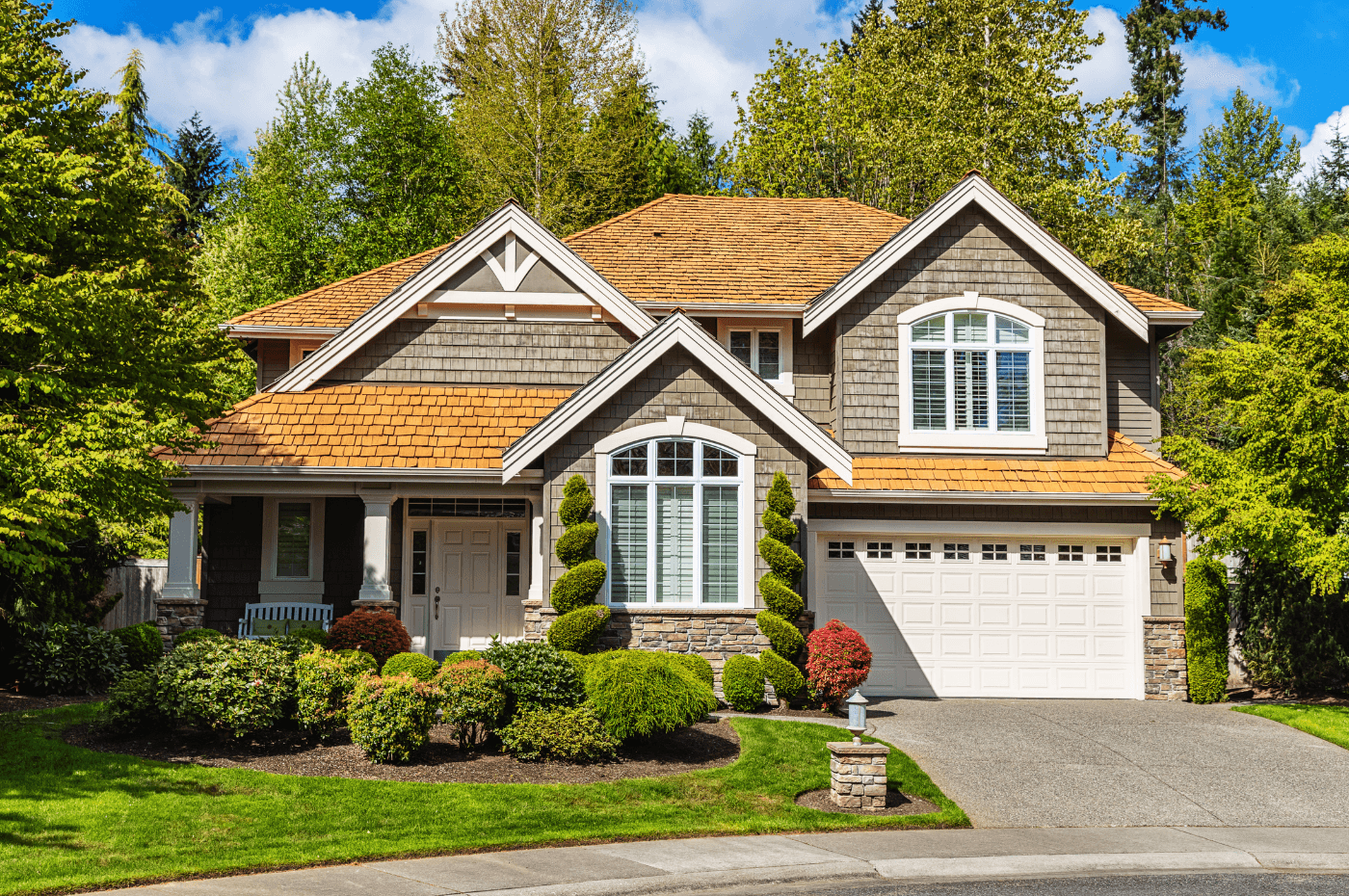

The type of property

The type of property also affects its market value. Whether it’s a condo, single-family home, loft, or semi-detached house, certain property types tend to be more desirable than others, influencing their demand and, ultimately, their market value.

-

The property's interior and exterior features

The appraiser will closely examine both the interior and exterior features of the property. Key elements that can influence the value include:

- The number of rooms and their layout.

- The size of the property.

- The number of floors.

- The size of the lot.

- The type of exterior cladding.

- The quality of materials and finishes.

- Additional features like a pool, garage, or shed.

-

The overall condition and history of the property

The appraiser will assess the overall condition of the property. Key questions include:

- Is the property in good or poor condition?

- Are there any maintenance issues or signs of wear?

- What renovations, if any, have been made?

- What is the extent of any deterioration if any?

These factors are essential for understanding how the property’s condition impacts its value.

-

The current real estate market

The current state of the real estate market is also a critical factor in property valuation. Market conditions, including supply and demand, can significantly influence the appraisal result. The prices of similar properties can fluctuate over time or vary by location, depending on the market's trends at the time of the appraisal.

Did you know?

Although a market value appraisal is based on an objective and impartial analysis, real estate appraisals are not an exact science. As a result, it’s possible for two different appraisal reports on the same property to arrive at slightly different values.

How to increase the value of a property?

Are you planning to sell your home and want to get the best possible price? The good news is that there are ways to increase the value of your property. Certain renovation projects are known to boost market value. Let’s explore some of these high-impact upgrades:

- The kitchen

- The bathroom

- The roof

- The basement

- Painting

- Extra storage space

- The doors

- Lighting fixtures

Eco-friendly renovations are becoming more and more popular, and they can help increase the market value of your property.

In any case, it’s crucial to research which renovations will truly add value to your property before you start. While some improvements may enhance the appearance or appeal of your home, they may not significantly increase its market value.

Real estate appraisal: what you should know

1. When selling your property, don’t base the selling price on its municipal value. Instead, rely on its market value to determine an accurate price.

2. While selling is a common reason for a property appraisal, there are various other circumstances where you might need one. These can include refinancing, settling an estate, or determining the value during a divorce or separation.

3. Although a certified appraiser is the most qualified professional for a property appraisal, a real estate broker can also perform the appraisal, but their expertise may not be as specialized.

4. When choosing an appraiser, ensure they are certified and registered with the Ordre des évaluateurs agréés du Québec (OEAQ).

5. The cost of a property appraisal can vary, typically around $650 for a single-family home, though several factors can influence this price.

6, In Quebec, there are three recognized appraisal methods, with the Comparable Method being the most commonly used.

7. Property type, location, unique features, general condition, and the current real estate market, all of these factors can affect the market value of your property, either increasing or decreasing it.

8. If you're looking to increase the market value of your home, certain renovations can help boost its value.

Looking for an expert to determine your property's market value?

XpertSource.com can help you find a certified appraiser or a real estate broker. When you tell us about your project, we put you in touch with qualified resources for FREE. Simply fill out our form ( it only takes a few minutes ) and we will connect you with professionals.