It’s no secret that Canada is facing a severe housing shortage. To meet the growing demand, home construction needs to be accelerated. To achieve this, the federal government now aims to involve homeowners.

How? By relaxing mortgage rules to encourage the construction of accessory housing units, such as converting unused basement or garage into rental units. Adding more housing units to existing property would help increase market supply.

This measure is part of a series of actions, including the relaxation of mortgage renewal rules and the return of 30-year loans, which the Canadian government has announced in recent months to address the housing crisis. Here’s what you need to know.

Easing of mortgage refinancing rules for renovations

Building or transforming part of a property into an accessory unit can be an expensive project, especially given the high borrowing and renovation costs. To encourage homeowners to take on such projects, the federal government is revising refinancing rules.

Starting January 15, 2025, homeowners will be able to refinance their homes for up to 90% of the projected value after renovations. The refinanced amount can also benefit from a maximum amortization period of 30 years, and the new loan can be insured up to $2 million.

These refinancing conditions apply to all mortgages, whether insured or not.

Eligibility conditions

To take advantage of this new measure, applicants must meet certain eligibility criteria:

-

Be an existing homeowner.

-

Intend to build one or more additional housing units.

-

Occupy one of the units or have a close family member occupy one of the units.

-

Commit to not using the additional units for short-term rentals.

-

Adhere to the maximum of four housing units, including the existing one.

-

Ensure that the newly built units:

- Are fully independent, with a kitchen and bathroom.

-

Have their own entrance.

- Meet municipal zoning requirements.

What is considered an accessory dwelling unit?

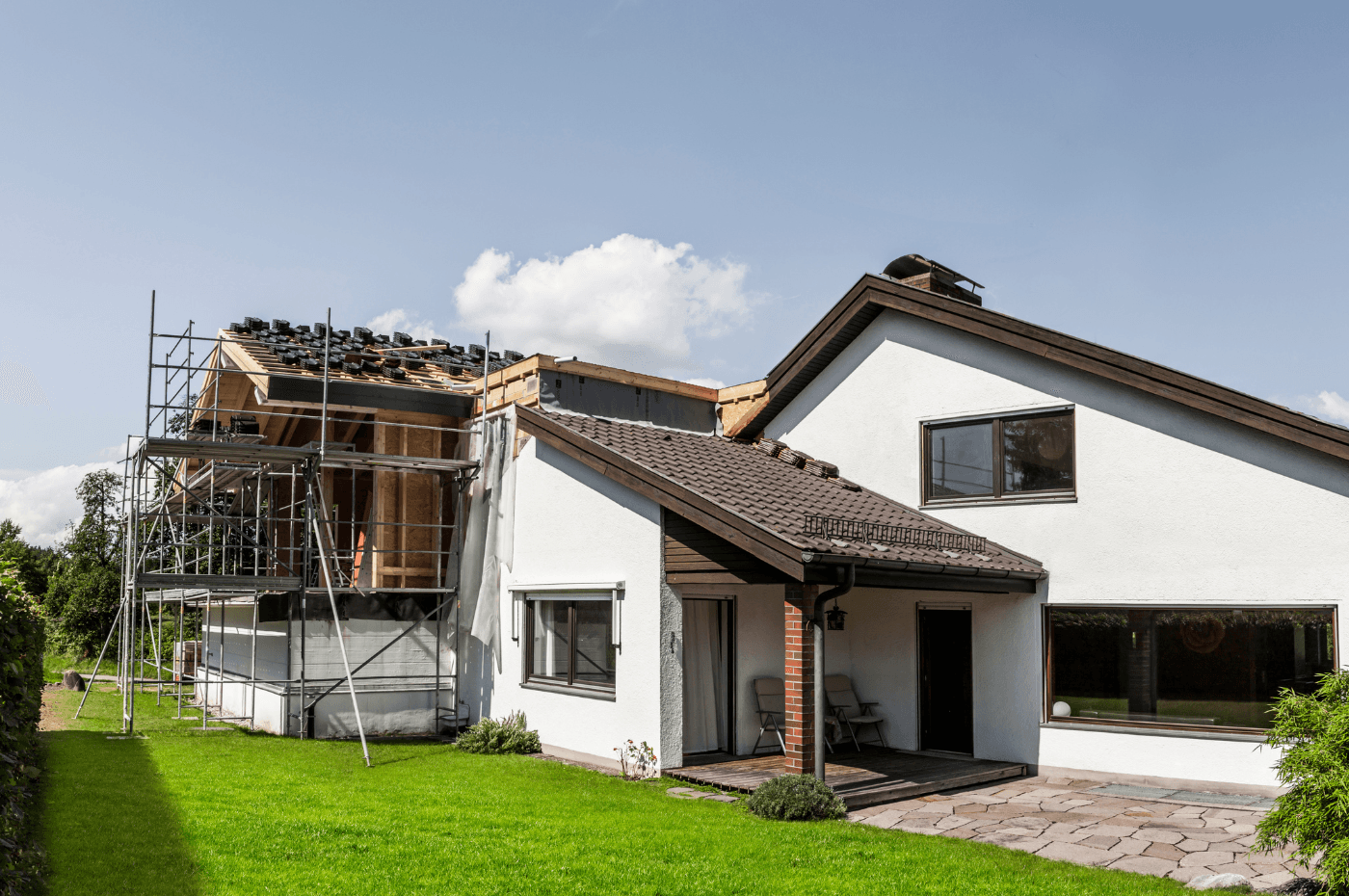

Accessory dwelling units (ADUs), also known as accessory housing units, are residences built on a lot that already has a primary building.

In other words, these are self-contained and private apartments within an existing residence. Examples include a garage or basement converted into a separate living space.

ADUs can also refer to dwellings built in an annex, whether attached or not to the main building, and constructed on the same lot. For example, an annex added to the ground floor, a space built above a garage, or a small house built in the backyard.

Adding a dwelling to your home to be closer to family or generate extra income

By easing mortgage refinancing rules, the Government of Canada is providing homeowners with the opportunity to be closer to their families. The accessory dwelling unit can help create more multigenerational homes, allowing space for grandparents, children, or other family members.

A homeowner can also create an accessory apartment to generate rental income. The new unit can be rented out to tenants who are not related to the homeowner, as long as it is not used for short-term rentals, such as on platforms like Airbnb.

In doing so, the homeowner can earn extra income to help pay the mortgage while contributing to the "great national effort" to accelerate the construction of new homes.

Will municipalities in Quebec adapt?

While the federal government's intentions are positive, implementing this measure on the ground could be more complicated. In fact, most cities in Quebec currently do not allow this type of development, although some are revising their zoning regulations.

Among the municipalities that already permit accessory dwelling units are Sainte-Catherine, Victoriaville, Quebec City, Granby, and Laval. However, even in cities where this type of housing is allowed, certain restrictions could make the project more difficult to execute.

Therefore, it will be necessary to wait for municipalities across the province to respond and determine whether this solution can be applied on a larger scale in the coming years.

Are you looking to refinance your mortgage?

XpertSource.com can help you in your efforts to find a mortgage broker. By telling us about your project, we will refer you to top-rated experts, free of charge! Simply fill out the form (it only takes 2 minutes) and you will be put in contact with the right experts.